What if you could step away from working for a week, month, or even a year and still be making money?

That’s passive income.

Income that comes in, even if you aren’t working.

It’s scalable, enjoyable, and allows you to create a lifestyle that isn’t possible from just active income.

So, what exactly is passive income, and what are some ways to earn passive income?

TABLE OF CONTENTS

What is Passive Income?

Passive income is a dream of many: earning a living while doing nothing. It’s important to know exactly what passive income is, that way you have something to aim for.

Passive income definition: true passive income is income that does not require active involvement – usually obtained through investing. It is a source of income that will come in even if you are not actively working.

However, don’t let this definition limit you.

While, yes, there are only a few truly passive income sources you can have, they almost always require you to have money to start. If you don’t have money, however, you are not out of luck. If you lack the funds, you can still invest time to build up passive income sources.

Time? Isn’t that the opposite of passive?

Spot on! However, if you have no funds, what are your options?

The only option is to invest time upfront, in place of money, and reap the benefits of passive income down the road.

See, you can build passive income over time, but you will need to invest either time or money to make it happen. There is no way around it (sadly).

For this reason, this list of passive income ideas will cover both passive income opportunities that can be obtained through either investing money or time.

Passive Income vs Active Income

The difference between passive and active income is huge: active income is income that comes from exchanging time for money. For example, the typical hourly, salary, or freelance jobs are all considered active income. Another way to identify active income is to consider what happens if you stop working. If you no longer make money, it’s active income that you are making.

How to Make Passive Income

There are three main ways you can make passive income.

- Investing money

- Investing time

- Capitalizing on things you already do

If you have money, you’ll have access to all three on this list.

If do not have money, you can still utilize number two and three. There is nothing wrong with this, it just means you should expect it to take longer to start earning passive income.

In this list, we go over ways to earn passive income with or without money, and some things you can do no matter which category you fall under. Before we start, though, here is how to use the list of passive income ideas.

Join our community of 1,542 people that are learning how to save more and earn more money every month, straight to your inbox.

Passive Income Rating System

To make using this list easier to sort through, you will find ratings at the bottom of each passive income idea. The rating will be ranked out of 1 to 100, the higher one is, the more prevalent it is in regards to that channel of passive income. These ratings include:

- Cost. This will factor the amount of money it will (usually) require to earn some passive income from that idea. Some on this list will be high, others are near zero. This is a good way to quickly identify if the idea is for you (or not) depending on how much money you have to put towards building passive income.

- Time. This factors the amount of time you’ll likely need to invest to achieve passive income from the idea. Typically, this will be higher if the cost rating is low, and vice versa. If you lack funds, you’ll want to be on the lookout for ideas that require higher-time investments with lower-cost investments.

- Potential. Every passive income idea has a different potential in terms of how much it can earn for you. This rating is based on personal experience and public case studies that can be found on the subject. The higher, the better. But also remember that this isn’t a good indicator in and of itself. For example, if it has high potential, it may cost a lot to get started and (or) require a lot of time upfront. But, there are a few gems in here that have a decently high potential upside for what you’ll have to put into it.

That’s it! Use these indicators carefully, because they don’t always tell the whole story. Hopefully, though, they act as a guide for you to a passive income source that fits your situation.

No matter if you have money, time, or both; anyone can benefit from #1 on the list:

1. Get paid for things that you already do

We all buy stuff. Whether that is groceries, clothes, gas, or anything else.

Getting money for these activities qualifies as passive income, right?

In my books it does! I mean, you literally are doing nothing (or almost nothing) extra once you sign up. As a byproduct, you make some money just shopping like usual, which you are then paid in real cash. You’re simply missing out on free money if you aren’t utilizing every cash back avenue possible.

Cash Back Credit Cards

Cash back credit cards are a big way to get some cash back on your everyday purchases. The amount you can earn varies, but you can usually expect to get anywhere from 1-5% cash back with rewards credit cards.

Trying to get the best rewards card is a challenge, especially since you want to avoid high fees and bad terms all while navigating your credit score. But once you find the right card, it’s worth it.

Think about this: with a cash back credit card, you’ll not only get cash back on all qualifying purchases from your credit card company, but you’ll also be able to stack cash back and rebate offers from these other ways to get money back just from shopping.

Maybe you want to stack as many cash back opportunities as possible. Or maybe you simply don’t want to commit to a new credit card (or already have one), that’s fair enough. Thankfully, there are so many cash back apps and websites around that can get you up to 40% cash back on purchases!

Ebates – Ebates has been around for a while, and for good reason.

They have cash back deals through their portal that range anywhere from 1% all the way up to 40%.

Plus, you can use it alongside a cash back credit card to really stack the amount of money you get back on every purchase you make.

It’s simple to use, just sign up on their website or their app, get their browser extension, and make sure to purchase with Ebates whenever shopping on a store they are partnered with.

Dosh App – the Dosh app allows you to connect your credit and debit cards, including your cash rewards credit card, and works in the background to get you cash back when you shop with one of their partners.

The app works automatically and requires zero effort on your part. Just shop like usual and you’ll get an alert every time you earned some cash back.

Capital One Shopping – The Capital One Shopping price protection tool won’t get you money back on the spot when you purchase something like the above services do, but this website offers something powerful: it gets you refunds for purchases you’ve made when something you bought becomes cheaper.

Capital One Shopping partners with websites (like Amazon, Macy’s, and more) to get you money back if the price of something you bought with them ever goes down or arrives late.

It works for you 24/7. Once you are signed up and connect your email, you do nothing but collect a check every time a price drops or your order arrives late.

Best part?

It’s 100% free. No catch. You even get to keep the entire refund amount.

2. Put money into a high-yield savings account

Keeping money in a regular bank account is almost the same as keeping it under your bed – it earns you nothing. Regular bank accounts pay so little (usually around 0.05% APR) which equates to nothing significant. Think about it, in a regular bank account $10,000 will earn just $5 per year, awful!

In addition, keeping the bulk of your money in a regular bank account (or worse, in your home), will lose value over time due to inflation. If your money loses value at 1-2% per year due to inflation, having your money in an investment vehicle that doesn’t return at least that much means your buying power is going down.

To make some actual money, and have a chance at beating inflation, a high-yield savings account is a way to do just that. It won’t make you rich, but if you need to have access to your money without incurring fees and want to play on the safe side, it’s a great option.

CIT Bank – one of the more popular online high-yield savings accounts is CIT Bank. Your money can earn 1.55% with them, which is around 25-times higher than regular savings accounts. On top of that, they charge zero fees. That same $10,000 that would earn just $5 a year in a regular bank account would make 31 times more in this account.

It gets better: if you want to earn 2.25% with their Savings Builder program, all you need to do is start with $100 and deposit $100 a month or maintain a balance of at least $25,000. That is one of the highest rates of high-yield savings accounts around.

3. Get paid to install an app

Imagine installing an app, doing nothing more, and getting paid for it?

Neilson Computer & Mobile panel wants to learn about internet usage and behavior and will pay you to be a part of that. However, they do strip any personal identifying information, so you aren’t selling your soul away.

They’ll pay you $50 a year, per device to have the app on your phone.

They are currently giving away $10,000 every month, too!

Real Estate Passive Income

Real estate is one of the most popular ways to generate passive income. Whether you invest in a REIT, crowdfund, or buy a rental property yourself, they all have their own passive attributes to them.

4. Invest in crowdfunded real estate

Typically, traditional real estate investment trusts (REITs) require you to be an accredited investor, have a high net-worth (or income), and lack transparency.

Heck, even buying your own rental property (below) isn’t realistic for everyone.

But with just $500, you can start investing in real estate projects with Fundrise and take part in their historic 8.7 to 12.4% returns.

$500 into a platform like Fundrise won’t make you a livable wage, but if you reinvest your profits and continuously build your portfolio size, it can add up over time.

Real estate crowdfunding with $5

If you don’t have $500, take away two zeros and you can get started with just $5 on Rich Uncles with their crowdfunded Student Housing REIT.

Real estate crowdfunding with $5,000

Take it up a notch and add a zero and start investing in real estate through Realty Mogul. Why would you want to choose Realty Mogul over the others that have much lower investment requirements? For one main reason: they offer lower fees. Think about it, if they require a higher minimum investment, fewer people will use the platform. In turn, they can afford to lower their fees because they can manage the same amount of money with less paperwork.

5. Buy a rental property

Buying rental property can be scary, especially if you’ve never done it before. It’s certainly a bigger risk than investing $500 into real estate crowdfunding, that’s for sure.

Thankfully, Roofstock exists.

They basically made a marketplace for full-service investment rental property purchasing.

They vet the homes, neighborhoods, and can even sell homes with tenants already living in them to start making you money from day one. You can get started with as little as 20% down.

Roofstock has done over $1 billion in transactions and is led by some great people, too. They guide you through it all and is an ideal way to get started in investment properties.

6. Rent out a room in your house

Renting out a room in your house on Airbnb can bring in some solid cash depending on where you live.

It’s not entirely passive, and you’ll have to deal with strangers living in your house, but the additional effort is minuscule. You’re (hopefully) already cleaning the house, now all you need to do is clean up that spare bedroom.

Utilizing what you already have to make money is extremely powerful, and Airbnb is a great way to make money from your house.

Investment Passive Income: Making Money with Money

You can use money to gain passive income in other ways besides just real estate. If you want to skip building any type of business, spending months building up passive income, then using money is the best way to do that. Here are some more ways you can invest your money (even if you only have a little bit) to build passive income.

7. Peer-to-Peer Lending

When people can’t go to a bank, they turn to their peers. In today’s world of the internet, that could be you.

LendingClub allows you to invest as little as $25 per loan and has historic returns of 3-8% per year.

That’s significantly a higher return than any savings account out there.

They also have had over 2.5 million customers and over $42 billion borrowed, so it’s a very popular p2p lending platform.

8. Invest with a robo-advisor

Using a robo-advisor allows you to put your money into an investment account, let them know your risk tolerance, and then sit back and let the robot do its thing.

The great thing about robo-advisors is they do their best to minimize fees and earn you the most money possible based on your risk tolerance, all for you.

Betterment – Betterment is a widely known, and popular, robo-advisor. Their annual fee is competitive with other robo-advisors out there at .25% per year. Their services allow for an entirely hands-off approach to investing, which is exactly what passive investing is all about.

9. Certificate of Deposit Ladders

With a little more effort and upfront thought, you can yield better returns with Certificate of Deposits (CDs) and a CD ladder strategy over high-yield savings accounts.

What is a CD ladder?

A CD ladder is simple: you get a multitude of CDs that expire at different times. This way, you can collect profits at different times to then keep or reinvest into another CD.

CIT Bank CDs – At CIT Bank, they offer many CD options. Some short-term, a no-fee CD, all of which have different rates. You can earn anywhere from 0.72% on a 6-month CD up to 2.5% on an 18-month CD, and everything in-between.

10. Get some dividend-paying stocks

Dividends are a distribution to shareholders from the companies profits. Not all stocks offer dividends, but those that do can provide a recurring income for you without doing anything other than holding onto the dividend-paying stock.

It’s a realistic goal to live off of dividends, but you’ll need some help.

Let’s take Walmart for example.

They have a 2.5% dividend yield right now. That means, every year you earn about 2.5% of the value of the stock in the form of a dividend. If you owned enough shares, this could add up to a nice, passive paycheck for you year after year.

Don’t get confused though, it’s not as easy as picking any company that pays dividends, you’ll want to pick winners that won’t lose value too. Plus, some yields are lower and others are much higher, reaching upwards of 20%!

Ally Invest – if you don’t yet have a place to buy and sell stocks and options, Ally Invest is a reliable option that offers extremely low fees of just $3.95 per transaction.

M1 Finance – another tool you can consider using to buy and sell dividend-paying stocks is M1 finance. They’re mostly focused on automated investing but still offer the ability to choose what you want to invest in.

11. Buy a profitable blog, website, or app

Buying a profitable online business can provide passive income online without the upfront work, that’s where money can come to great use. To build your own blog, website, or app to profitable levels, could take months. If you have some money, you can buy a profitable online business that’s already put in the upfront work and now is generating money passively every single money.

You’ll want to make sure the business model is passive. To do that, always ask yourself about the business model to ensure it is passive.

- If it’s a blog, how are they monetizing it? Ads and affiliate marketing is the most passive way blogs can make money, so you’ll want to be on the lookout for those.

- If it’s an app, will it need to be updated? Apps can require ongoing updates to stay relevant, and if you can’t program or want to hire anyone to do so, look for apps that won’t require updating and can will generate ad revenue just by sitting there.

- Any other type of online business, is it passive? Besides a blog that makes money from affiliates or ads, be on the lookout for any other passive income models online businesses are pursuing. Plus, does it really have to be 100% passive? If it was 80% passive and just required a few emails every week, would it be worth it? That is up to you to decide.

12. Become a silent partner

Becoming a silent partner is a solid way to become part of a business without having to run the day-to-day operations. You’re the moneylender for the most part.

This can work for a local or online business, depending on who you know and the opportunities you fall into. For example, you may know about the restaurant industry and feel comfortable investing in a restaurant and becoming a silent partner that way. On the other hand, you may understand the online space and invest in a startup that’s online.

All in all, being a silent partner is a surefire way to get some passive income in. It has its risks, the biggest one being that it could go out of business, but it also has one of the biggest upsides on this list. If it goes right, depending on your investment, you could earn a hefty amount of passive money every single month.

How to Create Passive Income with No Money

Not everyone has the money to invest in passive income-generating streams.

Your second-best bet? Invest your time.

When you are just starting out, this won’t be passive by a long shot. But if you stick with it, you can earn a hefty amount of passive income like many others have in the past (and still are) with these “time for passive income” investments.

13. Start a blog

We mentioned a bit how you can buy a blog and skip the building process, but if you have no money, you won’t really be able to do that.

Instead, building a blog from the ground up is the next best option.

It has its benefits though.

Such as, you get to pick the industry you are in. If you are skillful in something and see a way to make money from writing about it, even better!

Plus, you can monetize it with passive models from the start. This can be from things like ads, affiliate programs, or even a course that you create once and sell it.

Expect to put a lot of effort in here. It won’t happen overnight and might take months (if not years) to start seeing significant passive income rolling in from it. There is a light at the end of the tunnel though, some bloggers are making more than $100,000 per month right now – a fraction of that coming in passively wouldn’t be a bad place to reach, now would it? 🙂

14. Build an e-commerce website

Whether you dropship, private label, or create a unique product – an e-commerce store can run fairly passively.

You’ll need to fulfill orders, restock things, and deal with returns – but even all of those things can be outsourced once you make enough money from the e-commerce store.

Like a blog, you’ll need to put in some effort to find out the right products, marketing strategies, and fulfillment processes. Once you do this, the load is a lot easier and much more passive.

15. Make a course teaching a skill

Have some specific skills you could teach?

Maybe you can play the guitar, program, make beats, or even write: whatever you have a skill in, people will pay to learn about it.

After you’ve created the course, all there is left to do is sell it. Platforms like Udemy can bring you some sales passively, but it might not be enough depending on the skill you are teaching.

However, the bulk of the work is complete once you finish the course. From there, it’s really all about selling it.

16. Write an ebook

This is exactly like a course but in ebook form. After you’ve written up the ebook, it’s just a matter of selling it.

Just like Udemy can get course creators passive sales, listing your ebook on places like Amazon can also bring you sales passively. People are searching for the skill you know all of the time, and people will stumble upon your book. This alone can bring you some passive sales to your ebook.

17. Create music and earn royalties

If you are good at making popular music or beats, consider selling them. People and companies always have a need for unique music and beats, and making them once can yield you money as long as it’s popular.

I’m by far no good when it comes to music, but one unique, underrated opportunity that I’ve seen looking into this is: selling stock music. Think about those beats you hear at the start (or end) of videos, those are exactly what I’m thinking about. It’s something worth looking into!

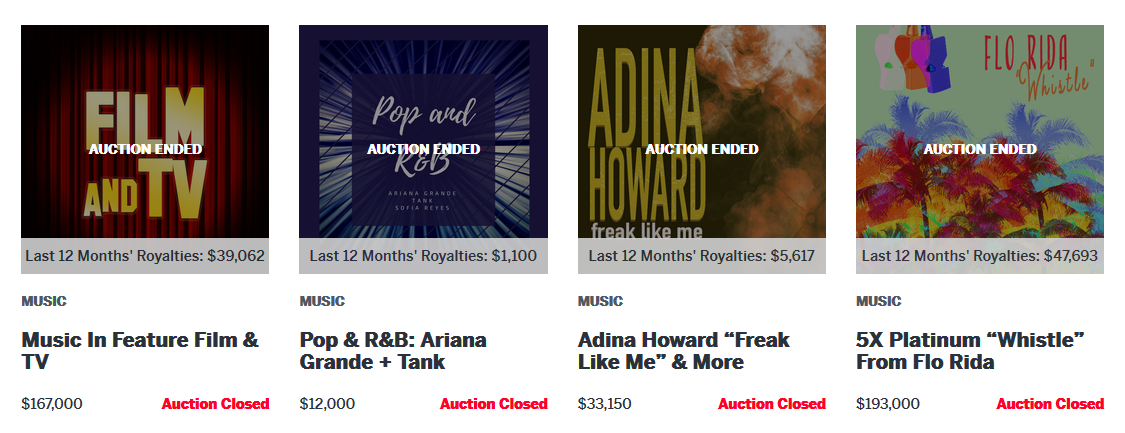

Not good at making music? You can actually buy royalties to music on Royalty Exchange.

To my surprise, some very popular songs go through this platform with some real figures. They aren’t all cheap, but the prices seem to range dramatically. Depending on your budget, you can pick up royalties for songs that can easily pay you for years, without doing much other than collecting the royalty check.

18. Start a YouTube channel

The number-one YouTube star right now is 7 years old.

Making millions.

Videos he made years ago still get views, which make him money through ads (not including sponsorships).

That’s passive.

The kid still uploads every single day, but if he stopped, his views wouldn’t (at least for a while). As a result, he has created passive income that he could take advantage of at any time because of the massive library of content and viewership he’s built up.

If you’ve got something worth watching, you probably won’t become the next YouTube star (although, you could!), you don’t need to. To make some decent money on YouTube, a million views per month will do wonders for your income.

Is that an easy number? No. But the potential for passive income is there, and even doing a fraction of a million views will bring in some great money.

20. Pay off any and all debt

Let’s think of debt payments and interest as anti-passive income. It’s the exact opposite of what you probably want: passive income.

The people who lent you money are the only ones getting passive income here, at your expense.

Getting rid of a debt payment won’t bring in any more money for you, but it will keep more money in your pocket every month. Same thing, right? 🙂

Obviously, in some cases, it might not be possible to pay off all your debt for years. In the meantime, you’ll want to be building another passive income source.

But, you don’t have to settle, you have options.

Refinance debt

If you have loans, like a student loan, that are locked in at a high-interest rate, refinancing can get you into a better rate. Doing this can give you immediate relief (and potentially thousands of dollars in savings).

Credible offers loan refinancing that offers some low rates, which can really save you some money. They’re so confident that they’ll give you the best rate that Credible will even give you $200 if you find a lower rate!

Consolidate your debt

Maybe you have credit card debt or other loans, consolidating them can be another good idea.

Credible also offers personal loans up to $100,000, perfect for consolidating a little (or a lot) of debt.

In addition to getting better rates for debt you may have, use the other passive income methods to make extra money to put towards paying debt off as fast as possible. The faster you pay them off, the less you’ll have to pay in interest. What better way to do that than with the aid of some passive income?

21. Take and sell professional photos

Got a good camera and decent photography skills?

If so, you can post your pictures on stock image websites. You’ll want to upload a wide variety of images for things people search for. That way when someone is looking for an image, they may stumble upon yours and purchase it.

In fact, I know this is a lucrative opportunity. I’m always on the hunt for great, unique images for my posts here on Dime Will Tell.

Here are some platforms you can publish your photos to sell:

Tracking Your Passive Income

As you grow various passive income channels, you’ll want to keep track of your finances more than ever.

PersonalCapital is a widely popular tool just for that.

They have a plethora of money and wealth management tools that will make managing your money, as you grow it, easy and less time-consuming.

And an ounce of prevention is better than a pound of cure by far when it comes to finances. Before things get too hectic, get control and create systems ahead of time. Otherwise, you’ll be in an expensive mess with a pricey accountant that has to get your finances up to speed.

A lot of their tools are actually free, so there is nothing that’s holding you back. Click here to check out PersonalCapital.

In Summary

By now, you may see that passive income isn’t what it’s all made out to be. If you don’t have money, you’ll need to put in some time upfront to obtain passive income. If you’re in a position where you have the money you can put towards building passive income for yourself, then you have that many more options to garner passive income.

There is no way around these two facts (that you need either time or money) when it comes to passive income. However, it’s a real thing and entirely achievable.

Use this list as a guide to diversifying your passive income sources. Create a plan, stick to it, and you’ll be surprised what is possible. With this list, it’s entirely possible to earn a living passively. Put in the time, sew seeds, work, and you will reap.

What’s your favorite passive income idea from the list? Have another lucrative one that wasn’t included? Comment them down below!

Dustyn Ferguson

Dustyn is a personal finance aficionado and the founder of Dime Will Tell where he writes about the experiences he's had with saving money, being debt-free, and building side hustles. He's been featured as an expert resource in publications like Huffington Post, Go Banking Rates, & Reader's Digest.

Join our community of 1,542 people that are learning how to save more and earn more money every month, straight to your inbox.